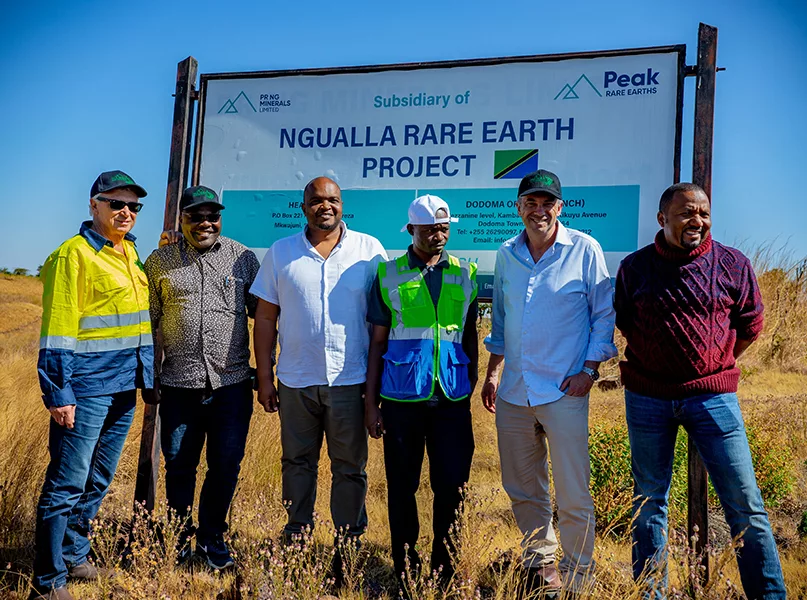

Rare earth development company, Peak Rare Earths, is developing the Ngualla Rare Earth Project in Tanzania. CEO, Bardin Davis, shares details of the project and outlines its significance in distinguishing East Africa as a leading mining location.

REACHING THE HIGHEST PEAK

Peak Rare Earths (Peak), headquartered in Perth and listed on the Australian Stock Exchange (ASX), maintains a Tanzanian head office in Dar es Salaam.

Peak is primarily focused on advancing of one of the world’s largest and highest-grade undeveloped rare earth projects – the Ngualla Rare Earth Project (Ngualla Project).

“The Ngualla Project has Australasian Joint Ore Reserves Committee (JORC)-compliant Ore Reserves of 18.5 million tonnes with a total rare earth oxides (TREO) grade of 4.8 percent, which supports an initial mine life of greater than 24 years,” introduces Bardin Davis, CEO.

Notably, the project’s ore reserves represent less than 20 percent of Peak’s overall mineral resources, which provides scope for potential mine expansions and life extensions.

For light rare earth projects such as the Ngualla Project, the most important contained elements are neodymium (Nd) and praseodymium (Pr), which are typically used in the production of high-strength permanent magnets.

The Ngualla Project’s ore reserves have an NdPr grade of 1.02 percent, second only to the Lynas Mount Weld mine in Western Australia (WA).

“The Ngualla Project deposit also benefits from very low levels of radionuclides such as thorium and uranium,” Davis reveals.

As such, the development will be able to avoid environmental and radioactivity issues that have typically plagued other rare earth activities.

A CAREFULLY CONSIDERED MODEL

Peak’s sequenced approach entails the initial development of the Ngualla Project as a mine and concentrate operation, before seeking to move further downstream.

“Under this approach, the development will initially produce a high-grade bastnaesite concentrate that will be sold to our strategic partner and offtaker, Shenghe Resources Holding Co., Ltd (Shenghe), for further processing,” Davis tells us.

Internationally active rare earth company, Shenghe, is listed on the Shanghai Stock Exchange (SSE) with a market capitalisation of approximately USD$2 billion. It is the largest importer of rare earth concentrate into China and is globally recognised for its expertise in the mining and processing of rare earths.

Once fully optimised, Peak intends to evaluate the development of a Tanzanian rare earth refinery that could further upgrade its concentrate to either a mixed rare earth carbonate or chloride product. Longer-term, the company could potentially move into the production of rare earth oxides.

Mirroring the successful strategy adopted by MP Materials (MP) at its Mountain Pass Project in North America, this approach reduces upfront capital requirements and lowers technical execution and development risk.

SUPPORTED BY SHENGHE

As the most advanced rare earth development project in the world, the Ngualla Project has been substantially derisked from a technical, regulatory, offtake, and funding perspective.

Completed technical studies include a bankable feasibility update and a front end engineering design (FEED) study. As such, all key regulatory approvals are in place, including a special mining licence and binding framework agreement with the Tanzanian government.

“Through a strategic partnership with our major shareholder, Shenghe, we have been able to establish an integrated offtake, development, and funding solution,” Davis affirms.

Shenghe previously played a critical role in supporting the restart of MP’s Mountain Pass Project by providing technical, offtake, investment, and funding support.

“Our binding take-or-pay offtake with Shenghe covers 100 percent of our rare earth concentrate and 50 percent of any downstream rare earth products for a period of seven years,” Davis details.

Peak has also recently announced the signing of a non-binding term sheet that supports an integrated investment, funding, and development solution for the Ngualla Project.

As part of a fully funded solution, Shenghe is set to invest AUD$96 million for a 50 percent interest share in a Peak wholly-owned subsidiary, which holds 84 percent effective interest in the Ngualla Project.

The remaining development costs are to be funded via a Shenghe-arranged debt facility. As such, upon completion, Peak will no longer have to contribute development equity to the Ngualla Project.

ENDLESS POTENTIAL

Peak believes that the Ngualla Project has the long-term potential to be both a multi-generational and multi-commodity project and a key supplier of a range of critical minerals.

The mine is also highly prospective for a range of other critical commodities, including phosphate, fluorspar, and niobium.

For example, earlier this year, the company completed a drilling campaign at the Ngualla Project targeting these commodities, which confirmed a major high-grade fluorspar discovery as well as widespread and high-grade phosphate mineralisation.

More recently, Peak signed a memorandum of understanding (MoU) with Tanzanian fertiliser group, Minjingu Mines & Fertiliser Limited, supporting the potential co-development of phosphate from the Ngualla Project.

“We see an exciting opportunity supplying phosphate to the Tanzanian and East African agricultural sector, which continues to be constrained by low crop yields and fertiliser supplies,” Davis informs.

Looking to the future, Peak is working closely with Shenghe to rapidly advance the Ngualla Project and complete its investment, funding, and development agreement ahead of a targeted final investment decision by the end of December 2024, which would support the commencement of construction early next year.

“Through our partnership with Shenghe, we hope to position the Ngualla Project as the world’s next rare earth project,” he concludes.